Frequently Asked Questions - Student Aid Index (SAI) and Pell Grant

What is the Student Aid Index (SAI)?

- SAI, or Student Aid Index, is replacing the term Expected Family Contribution, known as EFC. The SAI brings a change in the methodology used to determine aid.

- The SAI is a number used to determine eligibility for need-based aid. It is calculated using information provided by the student (and contributors, if required) on the FAFSA form.

- The SAI will replace the Expected Family Contribution (EFC) starting in the 2024–25 award year.

- A student’s SAI can be a negative number down to –1500 (negative 1,500).

- Important: Your aid eligibility is based on the following formula:

- Cost of Attendance (COA) – Student Aid Index (SAI) – Other Financial Assistance (OFA) = Need.

What is the main difference between the SAI (starting FAFSA 2024-25) and EFC (used until FAFSA 2023-24)?

The Student Aid Index (SAI) represents a change in the methodology used to determine aid:

- Child support received will now count as an asset instead of income.

- Family farms and small businesses will now count as assets.

- The number of family members in college is no longer considered in the needs analysis formula, but it is still a required question on the FAFSA® form.

- Additional information on the SAI formulas can be found in the 2024-25 DRAFT Pell Eligibility and SAI Guide

How is Pell Grant eligibility determined?

- Maximum Pell Grant - Students may qualify for a maximum Pell Grant based on family size, adjusted gross income, poverty guidelines, and tax filing status. Students qualifying for a maximum Pell Grant will have a Student Aid Index (SAI) between –1500 and 0.

- Student Aid Index (SAI) - Students who don’t qualify for a maximum Pell Grant may still be eligible if their calculated SAI is less than the maximum Pell Grant award for the award year. The student’s Pell Grant award will be equal to the maximum Pell Grant for the award year minus their SAI.

- Minimum Pell Grant - Students whose SAI is greater than the maximum Pell Grant award for the award year may still be eligible for a Pell Grant based on family size, adjusted gross income, and poverty guidelines.

What if I had a low income and was not required to file taxes?

- According to the IRS tax year 2022, these are the thresholds by filing status. If parents of a dependent student or an independent student (and spouse, if married) were not required to file a federal income tax return for 2022, the student will automatically receive a Student Aid Index (SAI) equal to –1500.

Why are assets different on the 2024-25 FAFSA?

- For the 2024–25 aid year, some financial information previously considered income will be considered as assets. Also, some information not requested previously, like the family’s small business, will no longer be excluded from asset reporting.

If students get a negative SAI, will they get a higher Pell Grant?

- Students with a negative or 0 SAI will be eligible for the maximum Pell Grant. The difference is that the negative -1500 SAI indicates the student has a higher need than the student with 0 SAI, being eligible for other grants, if available, like Federal Supplemental Educational Opportunity Grant (FSEOG) or institutional need-based grants.

If the family size is manually adjusted while completing the FAFSA, will the SAI only be calculated based on the size drawn from the taxes?

- It will be based on the family size that the family entered, if different from the taxes. Students may have to provide additional information to verify the household size if selected for verification.

What is the parallel between the 2024-25 Negative SAI and Pell Grant?

Negative SAI

- As low as -1500

- Non-tax filers receive automatic -1500 SAI (parents of dependent students or independent students/spouses are non-filers)

- AGI (if required to file a federal tax return)

- Household Size and number of parents

- Federal poverty guidelines

Will the Pell Grant still be based on enrollment status?

- Beginning with the 2024-2025 aid year, the Pell Grant will no longer be based on enrollment status. Instead, Pell Grant disbursement amounts will now be calculated using Enrollment Intensity - which is a percentage value based on the number of credits a student is enrolled for during a term.

- For federal student aid purposes, full-time enrollment is 12 credit hours.

- The chart below illustrates enrollment intensity relative to full-time enrollment. Note that enrollment intensity cannot exceed 100% for purposes of Pell Grant proration.

CWU News

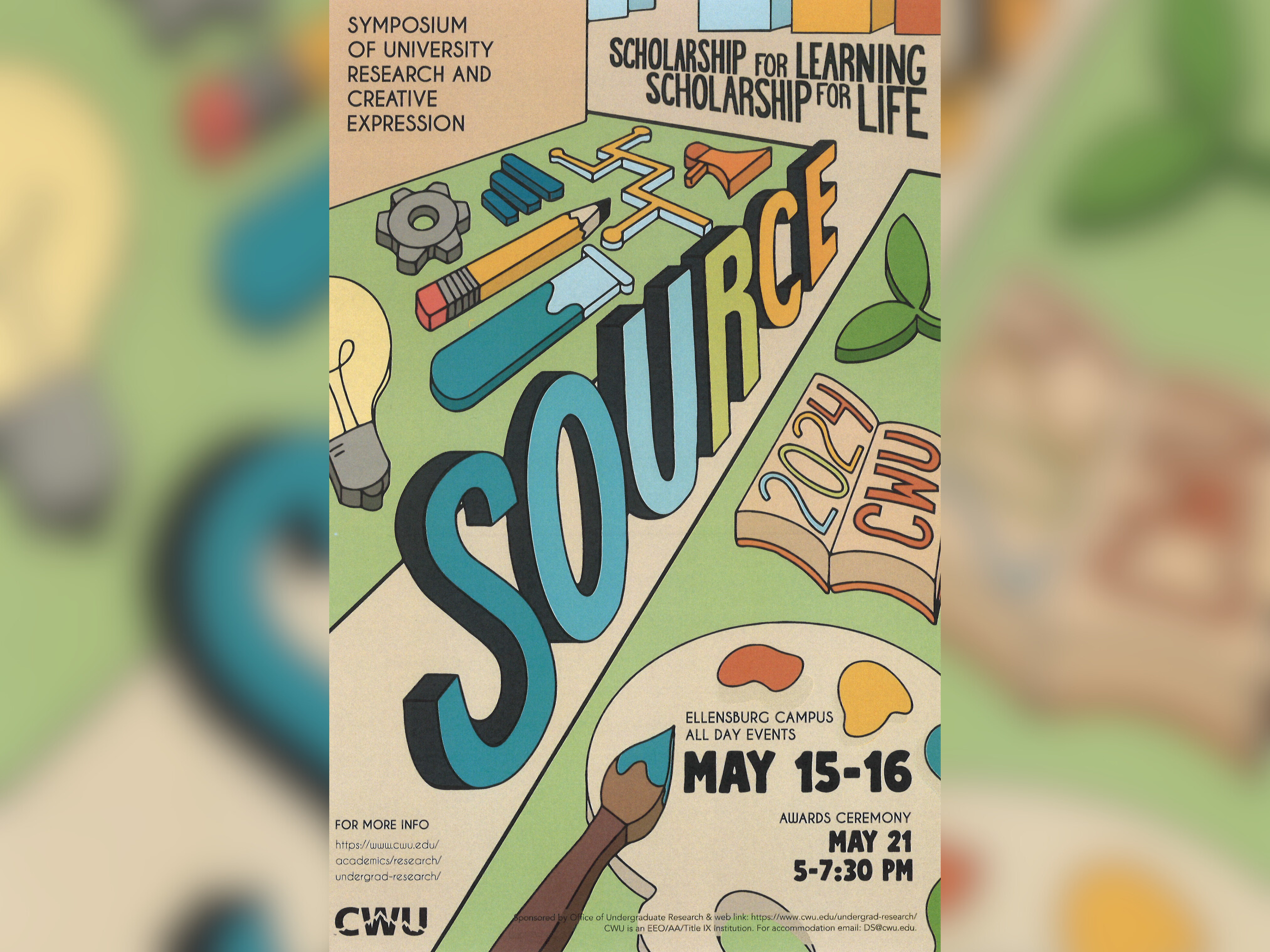

CWU to highlight student research at next week’s SOURCE conference

May 8, 2024

by Rune Torgersen

CWU Theatre and Film to present ‘Footloose’ the next two weekends

May 8, 2024

by University Relations